Risk256.com |

|

| Quantitative Financial Risk Management |

Books

- Quantitative Financial Risk Management

by Michael B. Miller

| |

A mathematical guide to measuring and managing financial risk.

Our modern economy depends on financial markets. Yet financial markets continue to grow in size and complexity. As a result, the management of financial risk has never been more important. TQuantitative Financial Risk Management introduces students and risk professionals to financial risk management with an emphasis on financial models and mathematical techniques. Each chapter provides numerous sample problems and end of chapter questions. The book provides clear examples of how these models are used in practice and encourages readers to think about the limits and appropriate use of financial models. |

|

|

Wiley's companion website. |

- The Volatility Smile

by Emanuel Derman and Michael B. Miller, with contributions by David Park

| |

The Black-Scholes-Merton option model was the greatest innovation of 20th century finance, and remains the most widely applied theory in all of finance. Despite this success, the model is fundamentally at odds with the observed behavior of option markets: a graph of implied volatilities against strike will typically display a curve or skew, which practitioners refer to as the smile, and which the model cannot explain. Option valuation is not a solved problem, and the past forty years have witnessed an abundance of new models that try to reconcile theory with markets.

The Volatility Smile presents a unified treatment of the Black-Scholes-Merton model and the more advanced models that have replaced it. It is also a book about the principles of financial valuation and how to apply them. Celebrated author and quant Emanuel Derman and Michael B. Miller explain not just the mathematics but the ideas behind the models. By examining the foundations, the implementation, and the pros and cons of various models, and by carefully exploring their derivations and their assumptions, readers will learn not only how to handle the volatility smile but how to evaluate and build their own financial models. |

|

|

Errata for The Volatility Smile. Wiley's companion website. |

- Mathematics and Statistics for Financial Risk Management, 2nd Edition

by Michael B. Miller

| |

Now in its second edition with more topics, more sample problems and more real world examples, this popular guide to financial risk management introduces readers to practical quantitative techniques for analyzing and managing financial risk.

In a concise and easy-to-read style, each chapter introduces a different topic in mathematics or statistics. As different techniques are introduced, sample problems and application sections demonstrate how these techniques can be applied to actual risk management problems. Exercises at the end of each chapter and the accompanying solutions at the end of the book allow readers to practice the techniques they are learning and monitor their progress. A companion Web site includes interactive Excel spreadsheet examples and templates. The Second Edition of this popular guide includes two new chapters. The first new chapter, on multivariate distributions, explores important concepts for measuring the risk of portfolios, including joint distributions and copulas. The other new chapter, on Bayesian analysis, explores an approach to statistical analysis that is particularly useful in dealing with the short, noisy data sets that risk managers often face in practice. |

|

|

Errata for the 2nd edition. Wiley's companion website. |

- Mathematics and Statistics for Financial Risk Management

by Michael B. Miller

| |

A practical guide to modern financial risk management for both practitioners and academics In a concise and easy-to-read style, each chapter of this book introduces a different topic in mathematics or statistics. As different techniques are introduced, sample problems and application sections demonstrate how these techniques can be applied to actual risk management problems. Exercises at the end of each chapter and the accompanying solutions at the end of the book allow readers to practice the techniques they are learning and monitor their progress. A companion website includes interactive Excel spreadsheet examples and templates. |

|

|

Errata for the 1st edition. Wiley's companion website. |

Orphan Chapters

The following papers were written as if they were chapters in a textbook. They are not research papers. They are an attempt to explain as clearly and concisely as possible important topics in quantitative financial risk management. They may become part of a book at some point, but for now they are orphan chapters. Enjoy. Feedback appreciated.-

Leverage

In this chapter, we examine the impact of leverage on returns. We also explore the concept of optimal leverage and the Kelly criterion.

Keywords: leverage, Kelly criterion, optimal leverage, introduction -

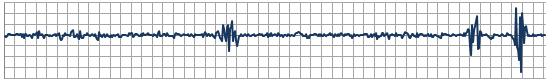

An Introduction to Value at Risk

This chapter provides an introduction to value at risk. We examine five basic models for calculating value at risk, and how to assess the effectiveness of value at risk models through backtesting.

Keywords: Value at risk, VaR, backtesting, delta-normal VaR, historical VaR, Monte Carlo simulation, Hybrid VaR,Cornish-Fisher VaR, Quantile Regression

Musings

These are non-technical papers on quantitative financial risk management.-

The History of Quantitative Risk Management and Modern Portfolio Theory

The history of quantitative risk management is clear when viewed through the lens of Modern Portfolio Theory. Many of the most important developments in risk management and many of our most challenging problems are readily apparent within this framework.

Keywords: Modern Portfolio Theory, MPT, Harry Markowitz, standard deviation, GARCH, jump diffusion, skewness, kurtosis, correlation, copulas, factor models, coskewness, cokurtosis, forecasting, peso problem, black swans, Robert Engle, Robert Merton, Nassim Taleb

Miscellany

Other pieces on quantitative financial risk management.-

Greek Maxima

For European options, at what price level is theta greatest and gamma highest? The answers and how to derive the answers here.

Keywords: European option, options, Greeks, theta, gamma, maximum, minimum, speed, charm, time decay -

VaR Exceedances at Large Financial Institutions (external link)

Seven years after the financial crisis, can large financial institutions accurately measure the market risk of their portfolios? Are large financial institutions simply too big to manage? Statistics reported by these institutions in their regulatory filings produce surprising results.

Keywords: value at risk, VaR, backtesting

Northstar Risk, my firm, also has a small but growing collection of risk research papers on its research page.